Hello and Welcome all Bulls!

COMING AT YA HOT, YA’LL READY TO TRADE THIS WEEK? LETS GET TO WORK ON A FEW OBSERVATIONS AND NAMES I LIKE!

Where at on the Economic side of things?

AMZN up, FB (meta) Down

EARNINGS THIS WEEK…

I’LL BE LISTENING TO THE PELOTON CALL FOR EVERYONE ON TUESDAY, KO IS NOTABLE, HEALTH CARE NAMES IN $CVS, ASTRAZENECA, PFIZER THIS WEEK. BIOTECH/HEALTHCARE COULD BE BIG SO CHECK THAT

$LABU FOR A AN EASY SWING FROM TUESDAY-THURSDAY IF…

Pfizer beats, which I think it will!

REPOST!

-

$GS– What do I always say about $GS? Besides $AXP– this is the stock you can buy in replace of a sector if you’re building a smaller, less diversified trading account.

-

I’ll state that again,… if you don’t want to trade and just want to add good banks to your portfolio- Just buy $GS

-

My FAVORITE financial stock/bank stock of all time (and Warren Buffetts) IS $AXP

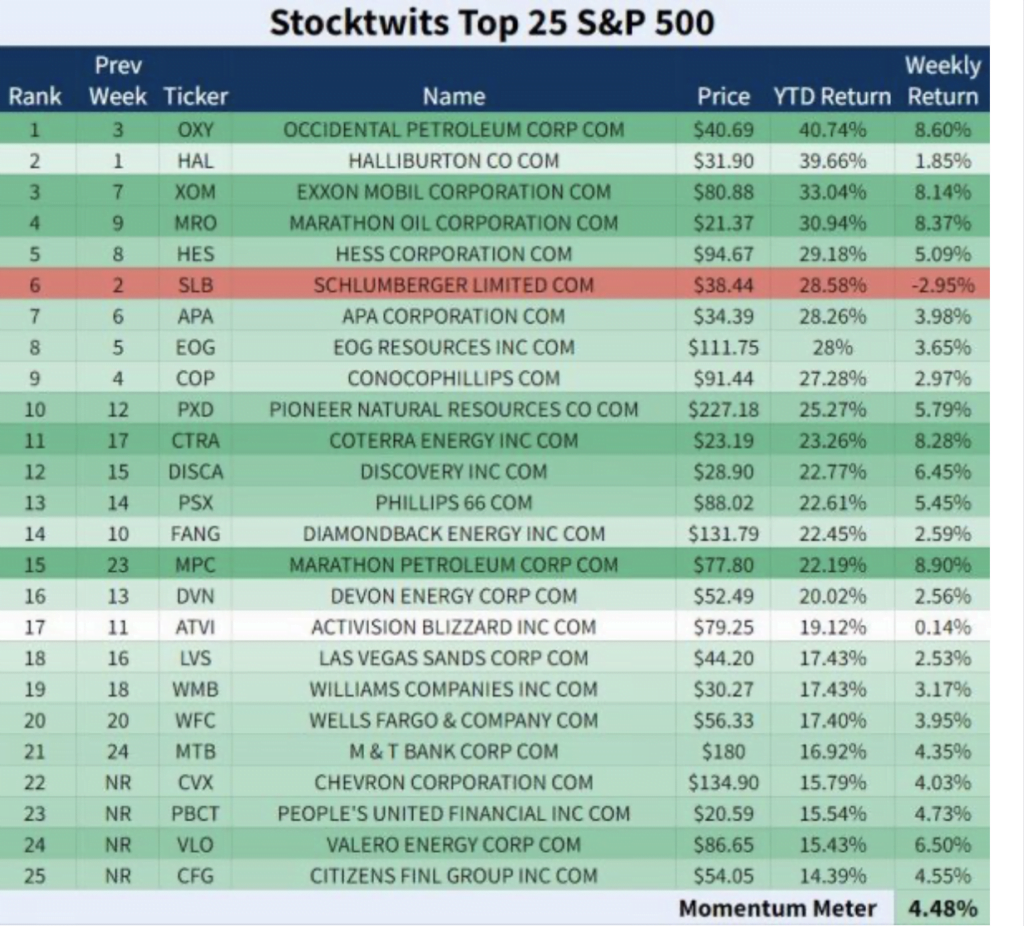

Don’t forget the Pro TIP I gave ya’ll last month on the SUBSTACK- Early in the year like this we can look at the StockTwits Top 25 and implement the “Buy High, Sell Higher” strategy, this is the SMASH THE EASY BUTTON idea!

Horn Toot for The Sherpa! We crushed the timing on the OIL stock call in last weeks game plan! Tell a friend!

HINT: add these stocks to a watchlist- hit the fucking easy button

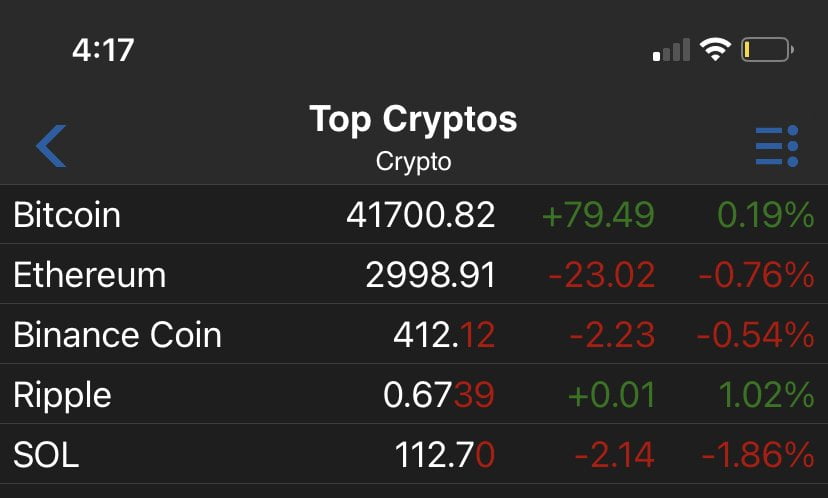

CYPTO FRONT

REMEMBER LAST WEEK BTC was $37K and ETHE was $2700!

GOTTA THINK BTC AND ETHE BREAK UPSIDE AT LEAST BACK TO PREVIOUS HIGHS AT SOME POINT THIS YEAR RIGHT?

YOU LISTENING LTHERS? LEAPERS? TRADERS? CASH HOLDERS?

REMINDER: FULLY INVESTED EX CRYPTO- WE NAILED THE TIMING ON THIS TOO! GO TO EVERBULLISH.COM AND BUY A PORTFOLIO AND START BEING THE SHIT OUT OF THE MARKET TODAY!

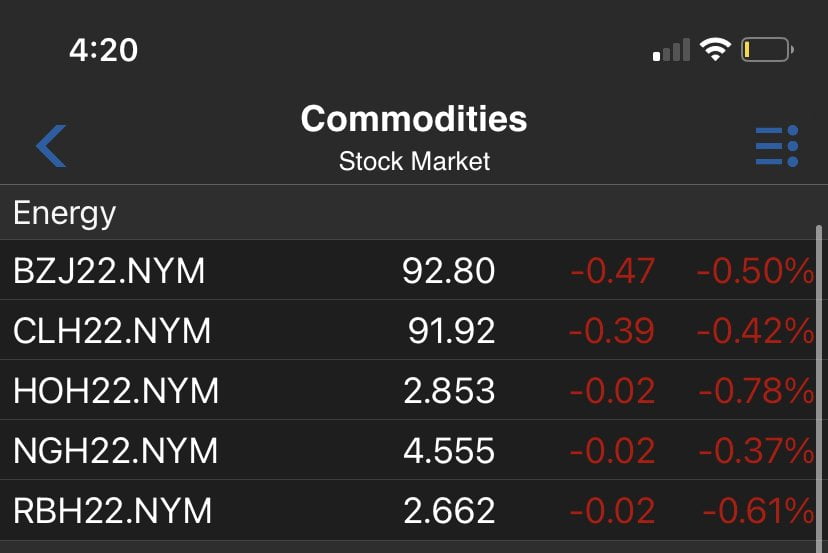

COMMODITIES FRONT

LOOK AT HOW GREAT OIL IS… and HOW ATROCIOUS GOLD IS!

REPOST!!!!!! REPOST!!!!!! REPOST!!!!!!

STILL TRUE!!!!! CONGRATS ON THOSE WHO TAILED!

3 HEAVY TRADES THIS WEEK!!!!!!!

BUY ON $LABU

OPTION ON FAS MAKES SENSES ON A DAY DAY ONLY.

OTHERWISE, LONG SWING TRADES ON TUESDAY AT 10:30 AM FOR THE LIST ON STOCK TWITS ABOVE.

ENERGY PRICES WENT UP ABOUT 5% OVER THE WEEKEND, BRIGHT SIDE ON DELTA VARIANT BEING LESS HARMFUL AND POST HOLIDAY TRAVEL- BUY ON CPE/FANG/DVN/MRO

BEST BET IS A 1 MONTH LONG SWING TRADE IN $FB

STILL LOVE $FAS THIS YEAR

3 BEST BETS AND A HUNCH!

-

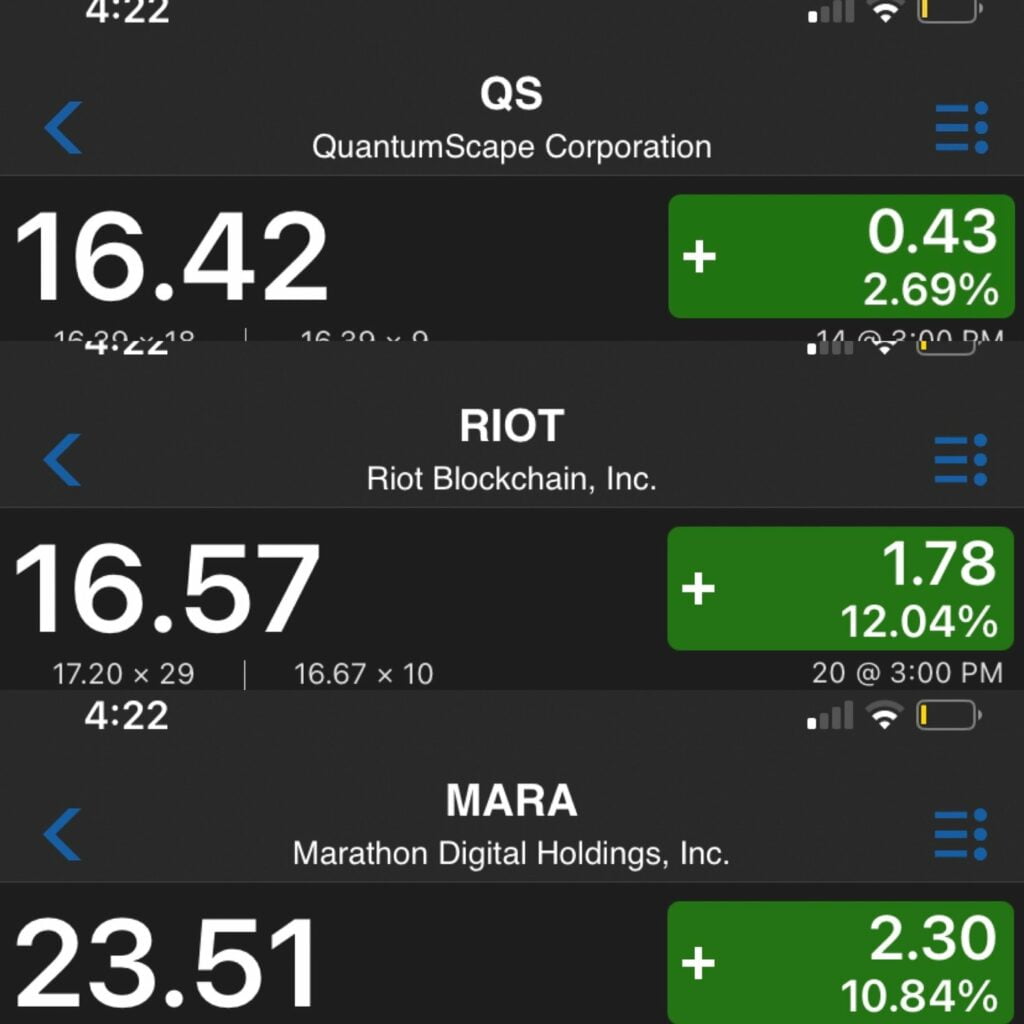

$MARA trade is BACK ON

-

$RIOT trade is BACK ON

-

$FAS on Monday

-

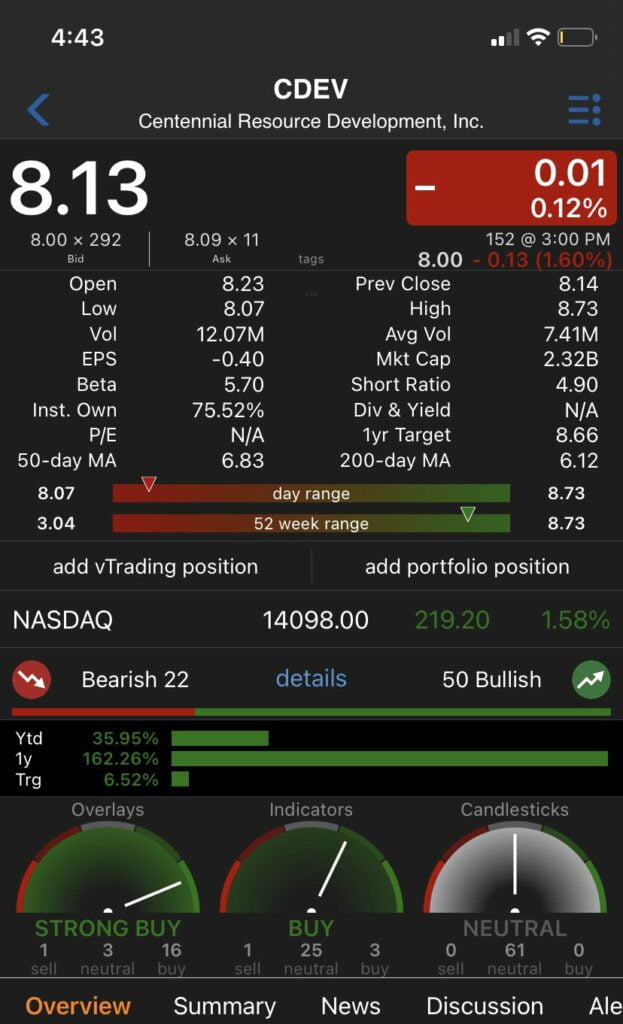

$CDEV- ON TUESDAY! (HUNCH)

THIS IS A SMALLER SIZED OIL STOCK THAT I AM SUPREMELY BULLISH ON THIS YEAR!- HINT, HINT. REMINDS ME OF THE $CPE WINNER LAST YEAR!

Don’t forget to help a brother out!

Subscribe to my substack, buy my portfolios, and come with me to the top of the mountain!

Finally, please help spreading the word on all social media especially IG and Linked in. It means nothing to you and everything to me!

Who’s ready for the option of the week? For all my bulls who stuck to the end! Ride with The Sherpa this week!

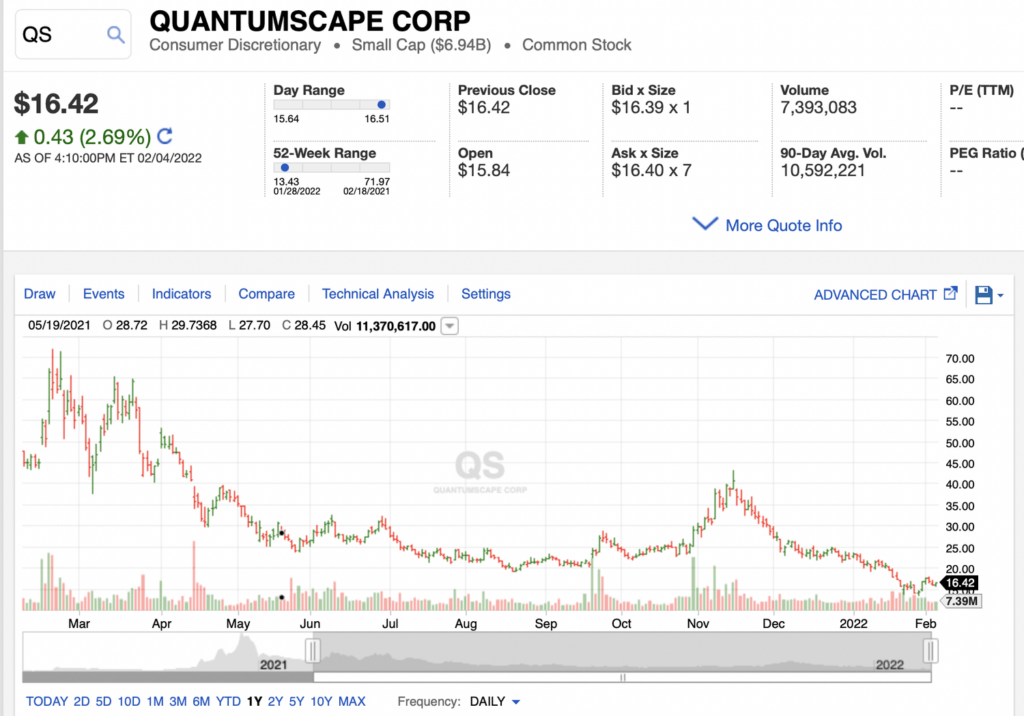

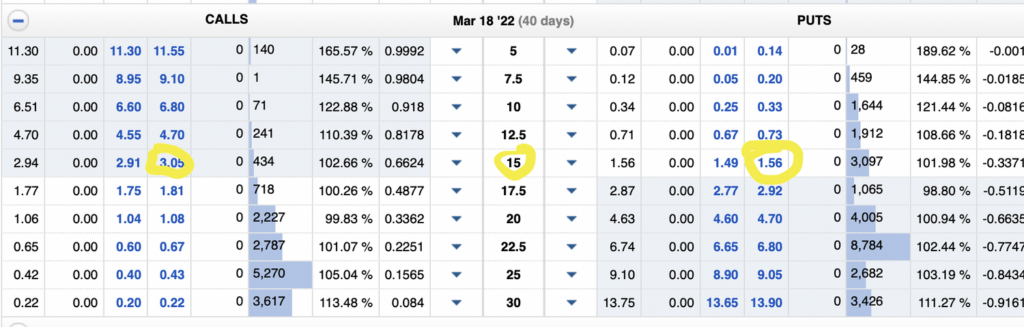

STRADDLE TIME! Just like on $ARKK last week we buy the Calls for 3.05 and the Puts for $1.56 both with the same strike price of 15 on March 18th. Don’t care if it moves up or down, just that it moves outside of that $18.05 on the up side, and $13.44 on the down! THIS IS BUYING Volatility BULLS!

FOLLOW ME TO THE TOP OF THE MOUNTAIN!

FOR THE GAMEPLAN ON MONDAY AND ALL MY CONTENT IMMEDIATELY CLICK HERE TO MY SUBSTACK.