BULLS!

INCASE ANYONE OUT THERE WAS NOT YET SURE, OR HAS ANY DOUBTS OF WHAT THE MARKET IS DOING RIGHT NOW.

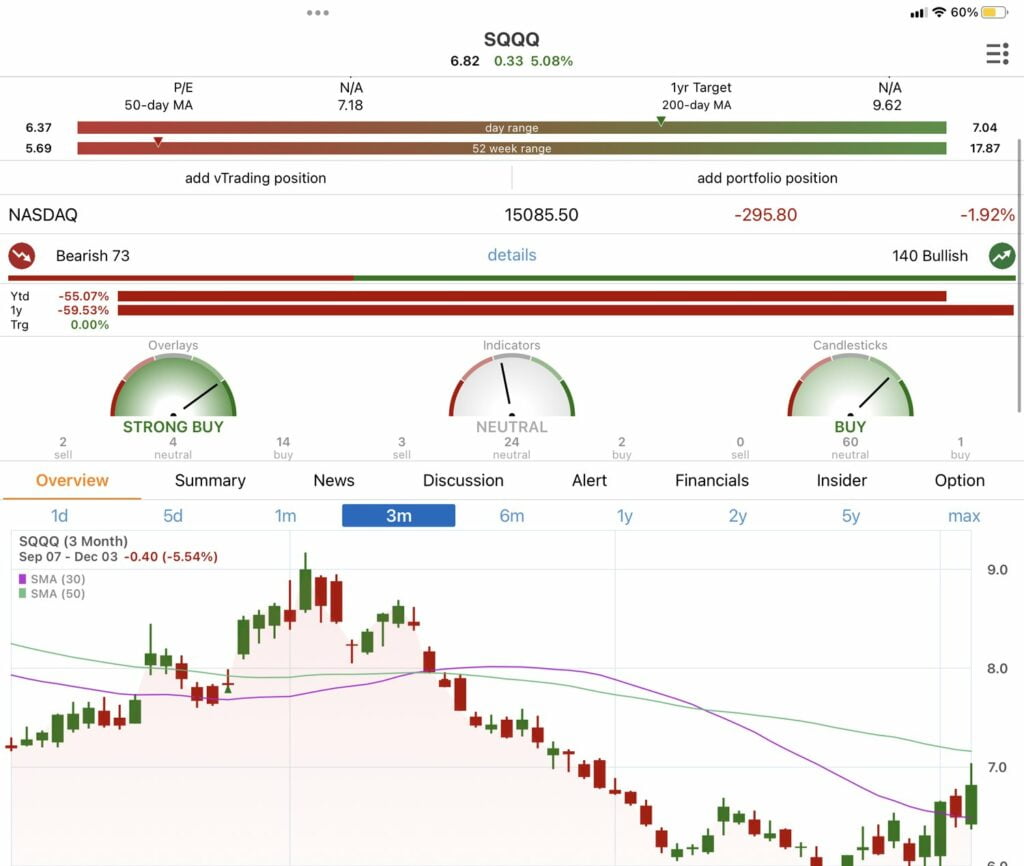

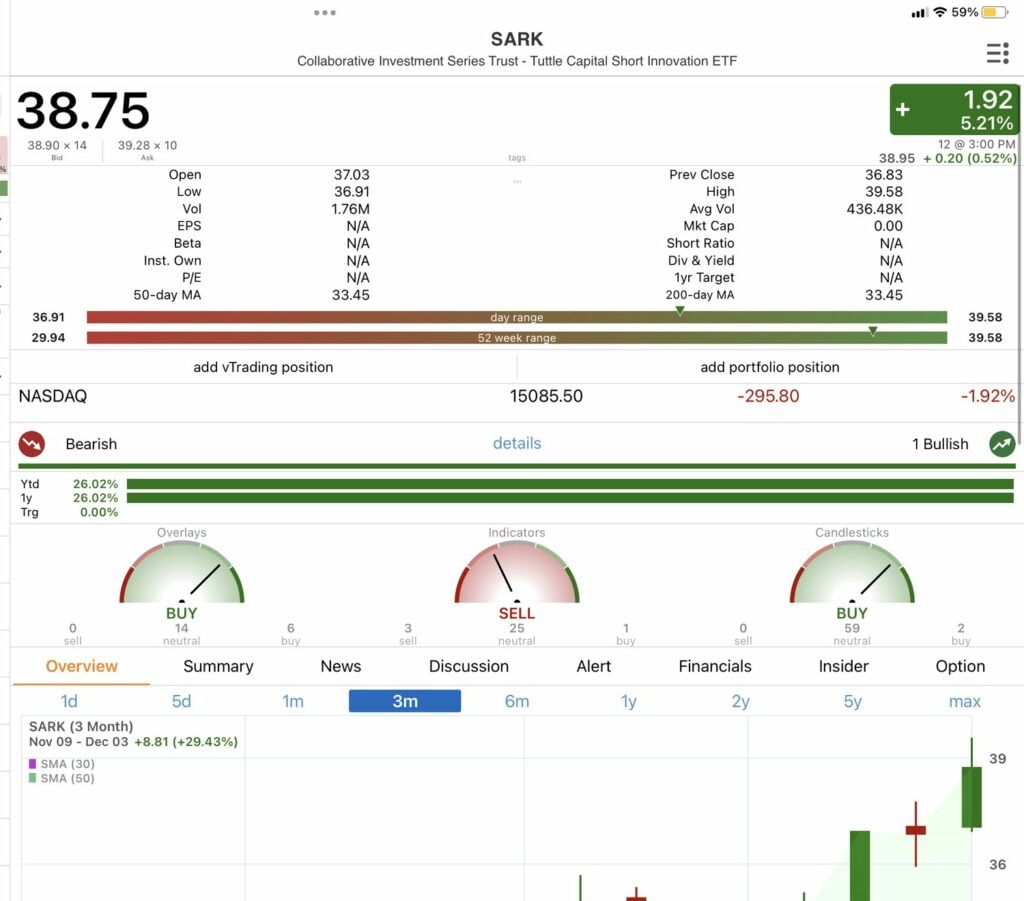

THIS IS WHAT A PANIC LOOKS LIKE.

YOU CANNOT BE AFRAID TO TAKE LOSSES…

THE MARKET DOENS’T GIVE A FUCK ABOUT YOUR BASIS…

BEING AFRAID TO SELL WILL KILL YOUR ACCOUNTS…

BY THE WAY THIS IS WHEN YOUR ADVISORS TELL YOU TO STAY INVESTED,

AND WHY EVERBULLISH IS SIMPLY BETTER. I DONT HAVE A BOSS TO GET MAD AT ME FOR TELLING YOU THE TRUTH. GO BUY THE EVERBULLISH PORTOFLIOS THAT SOLD TO CASH ON WEDNESDAY.

SO WHAT IS GOING ON? WHAT IS CAUSING ALL OF THIS

What is rule number 1 at EVERBULLISH???

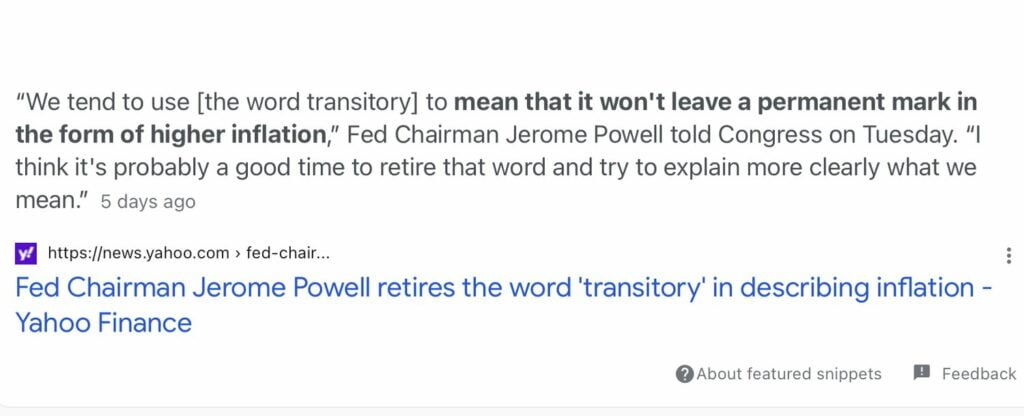

FOLLOW THE FED

REPOST!!!!

Jay Powell Added to risk off sentiment- discussing bond taper coming sooner? VERY SURPRISING HAWKISH COMMENTS- (TELLING THE KIDS WE HAVE 5 more minutes to leave the party) First last call!

1.) NEW DEVELOPMENT- NOT GOOD! JAY POWELL HAD A CLARIFYING COMMENT THAT THE WORD “TRANSITORY” BE REMOVED FROM THE DESCRIPTION OF INFLATION.

REPOST- I WAS DEAD WRONG ON THIS CORRELATION… Not happy About it.

News of Omicron Variant- Lowering risk appetites- Material drop in the efficacy of the Moderna vaccine. I this again confirms my bullish bet on BIOTECH and $LABU. These are innovations we need and besides that the charts are SEXY AF.

I still don’t believe that the panic here is really about the Virus as much as a “Cold Water” moment to re-analyze the insane valuations of the market, which were a direct result of 13 years of “easy money” policy.

-

5.) TRAVEL BANS, TIGHTENING PROJECTIONS ON OIL, JET FUEL AND CONSUMABLES IS LOOKING BEARISH DUE TO THE NEW VARIANT.

2.) TAX LOSS HARVESTING-

With the wash sale rules many of the heavy tax lost harvesting happens at the beginning of December so they can rebuy at the beginining of the year.

We see this commonly in Big Name and Tech heavy stocks…

Especially those that have Run Up huge this year… (Tesla, ZM, DOCUSIGN)

3.) JOBS REPORT WAS WAY OFF

4.) CRYPTO REVEALED ITSELF AS NOT CORRELATING NEGATIVE TO THE MARKET… WHEN CORRLATIONS BREAK, I STOP TRADING.

5.) INTEREST RATES DROPPED LIKE A ROCK!

I WILL REPEAT… THE MARKET DOES NOT CARE ABOUT YOUR BASIS- I BELIEVE THAT SELLING OUT WHEN CORRELATIONS STOP MAKING SENSE IS THE BEST WAY TO PROTECT YOUR MONEY, AND THEN…

BUY BACK LOWER!

THATS THE END FOR THE YOUTUBE AND EVERBULLISH.COM SUBSCRIBERS.. Go subscribe to the substack to see the trades that will make money off of this mess…

THESHERPA.SUBSTACK.COM- CLICK HERE

OK MY OG’S AND MARKET BALLERS- HERES THE DEAL…

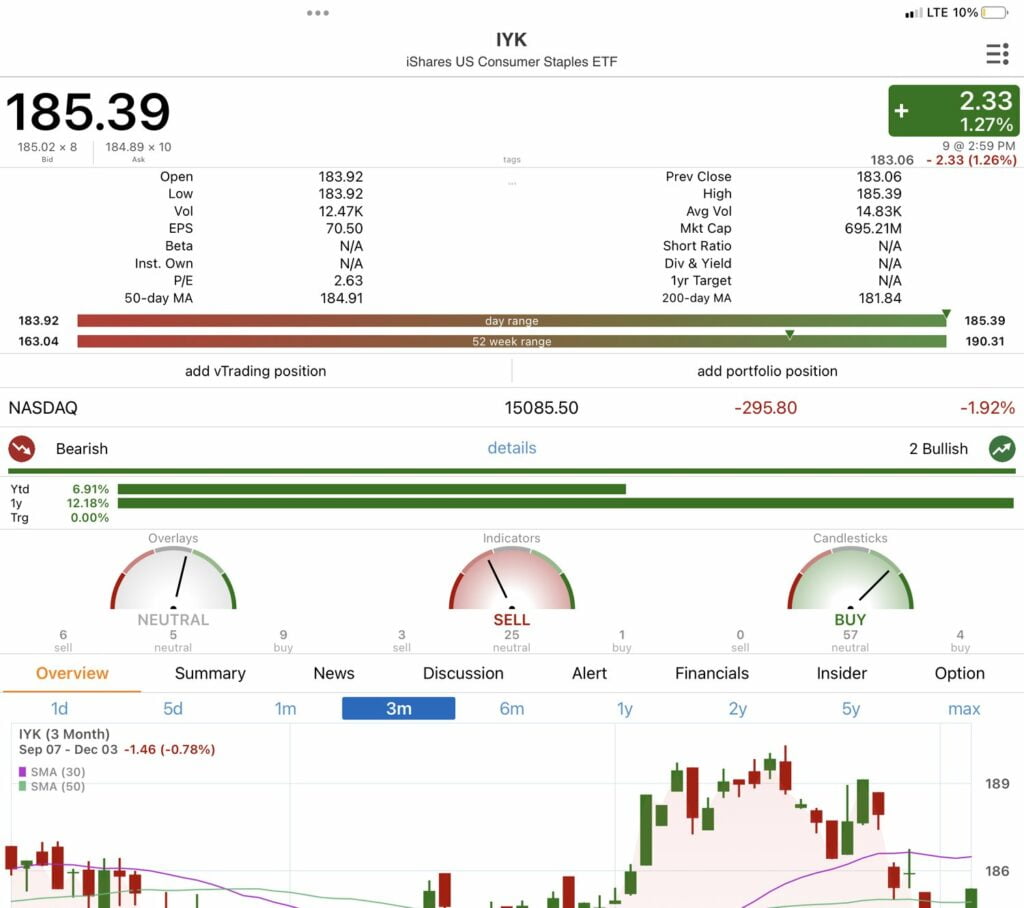

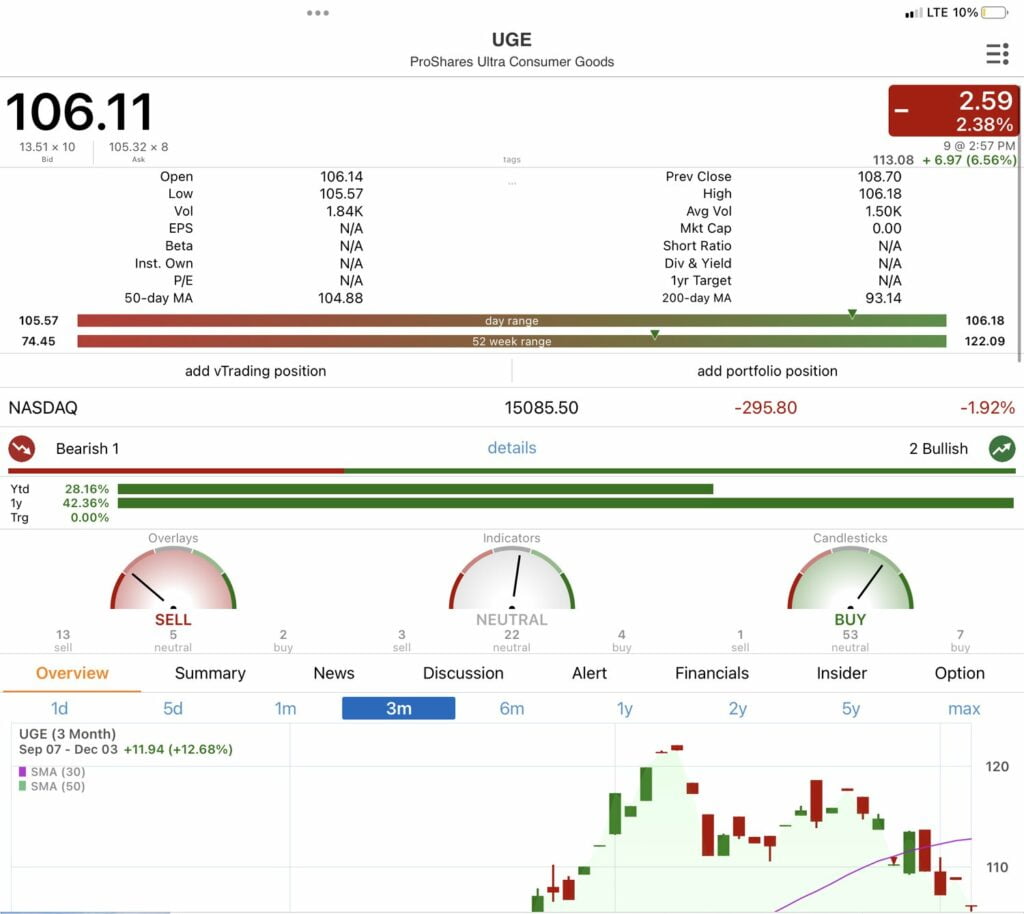

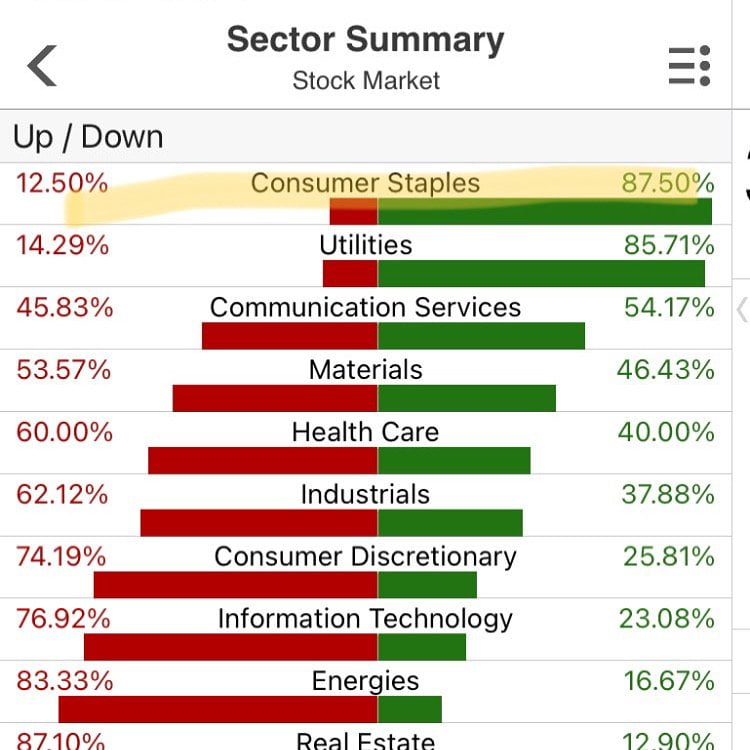

OF ALL OF THE THINGS THAT BOTHER ME ABOUT THE MARKET NEWS I MENTIONED ABOVE, THE THING THAT CONCERNS ME ABOVE ALL, IS THE FACT THAT CONSUMER STAPLES AND INDUSTRIALS TRADED UP 5-1 IN THE SECTOR SUMMARY CHART.

YOU KNOW I HATE CONSUMER STAPLES AND INDUSTRIALS– THEY’RE BORING AND THEY DONT MAKE MONEY UNLESS THE MARKET IS CRASHING… AND IN THIS CASE, IT SHOWS THAT IT IS NOT JUST TAX LOSS HARVESTING BUT MONEY MANAGERS MOVING HEAVY DOLLARS TO DEFENSIVE STOCKS.