Happy Turn-around Tuesday!

Today the market is going to tell us (with real institutional buying on Tuesday rather than Monday) how exactly the market is going to digest the stimulus and helicopter money that is going to be injected into the hands of millions. Let me just say, don’t overthink this one- BULLISH all the way- in this case- it’s hip to be square. The easy side of the trade hypothisis says more money in consumer pockets equal easy money policy that will continue in the near term- The tech pullback is showing us where the bases are for large stocks like $TSLA, $AAPL, and $AMZN.

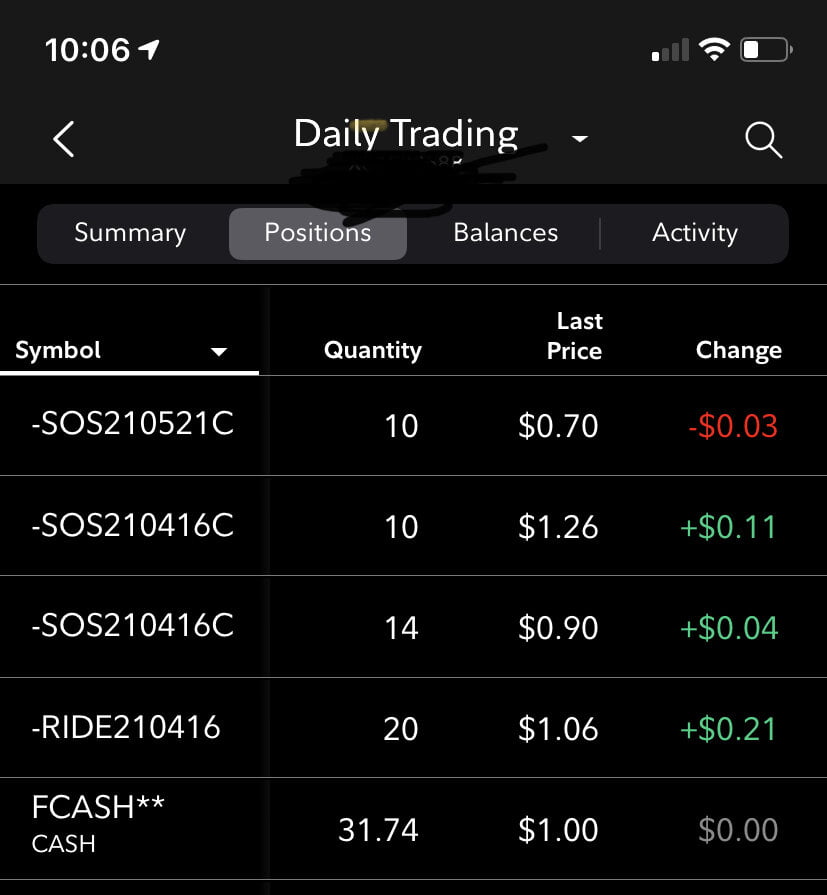

OPTIONS TRADING IS VERY RISKY AND IS NOT INTENDED AS GUIDANCE OR ADVICE!

I am currently in a small hole from last week when I bought options on $SOS and $RIDE but have almost no fear on either of these trades. There is an obvious disconnect in crypto miners like $RIOT, $MARA, and $SOS. As a day trader you must exploit the biggest disconnect so i’m deep in and confident in the $SOS trade. I like 45-90 days out, roll them on down days to the later option of the same price.

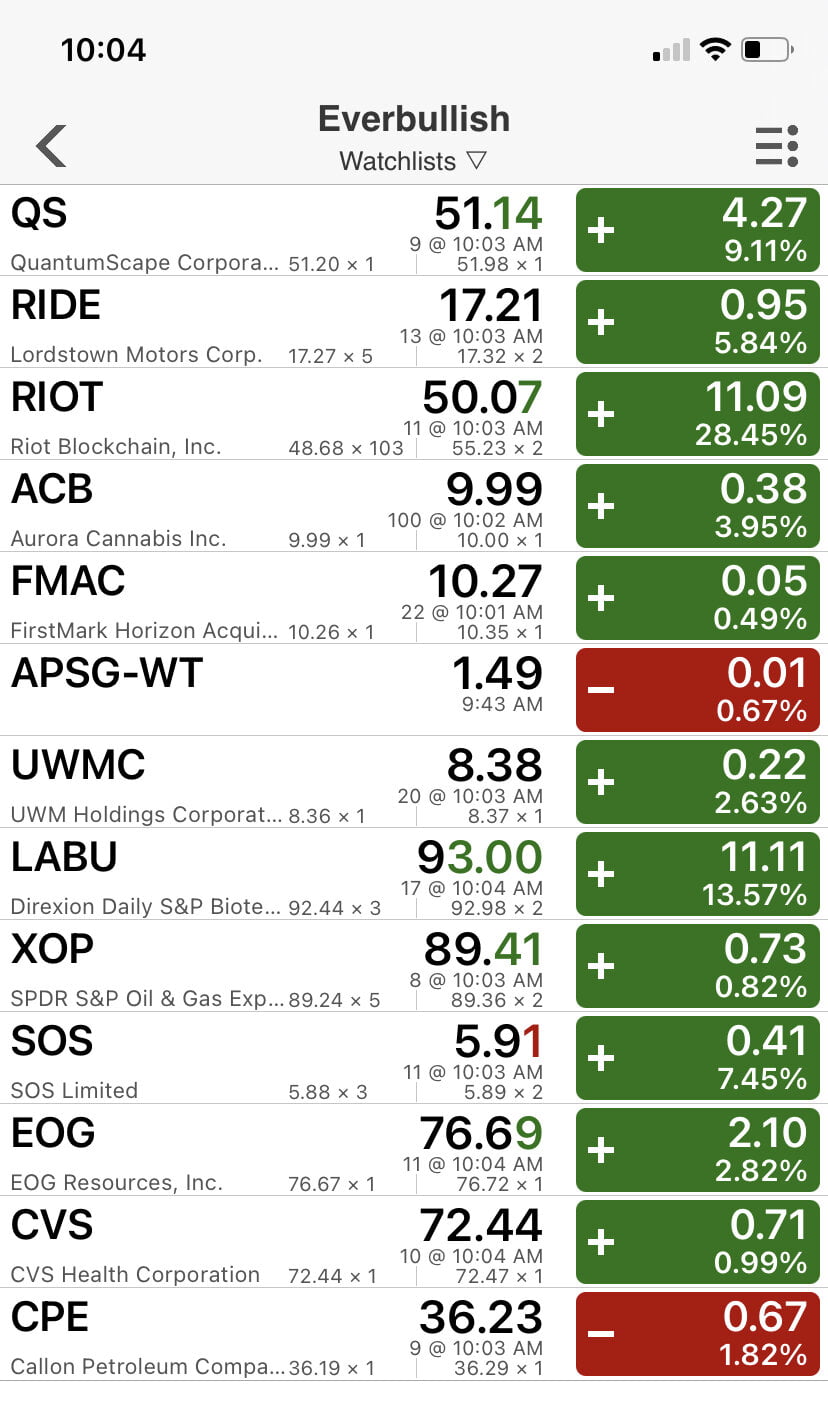

For swing traders have a look at the watchlist below:

Thats the plan for the week as we move forward on “Turn-around Tuesday.”

Happy Trading and LGR!

Chase @ Everbullish

Guadalupe River. New Braunfels, TX- rainbow trout season is upon us.