BULLS!

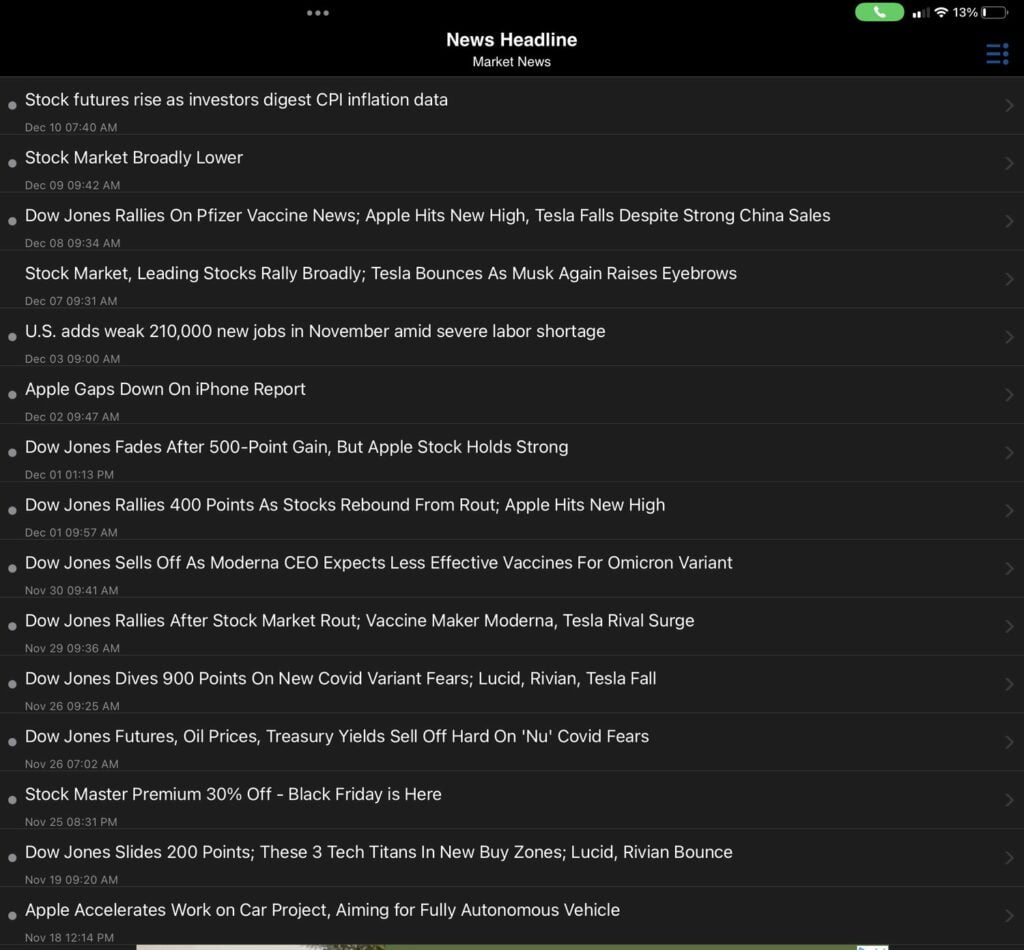

This December has been marked by High VOLATILITY on the sell side, particularly in Tech, Oil, Financials, and a rally in Consumer Staples. This is always concerning especially when the markets are at the mercy of the Fed, and Politicians.

THIS AGAIN is why fundamentally believe in selling out when times get sketchy and I’m proud to say that the EVERBULLISH portfolios missed much of the recent downs!

A second leg of the strategy now is to take a look at the TEA LEAVES in EARLY JANUARY, and Late December to form our hypothesis on next year

STRAIGHT UP LETS LOOK AT THE FACTS OF THE MARKET AS STATISTICS OF THE BEGINNING OF THE YEAR AND GET YA’ LEARNED UP!

-

JANUARY’S BAROMETER PREDICITS THE COURSE OF THE YEAR (UP OR DOWN) WITH .743%- SP500

-

EVERY DOWN JANUARY ON THE S&P SINCE 1950, PRECEEDED A NEW OR EXTENDED BEAR MARKET, A FLAT MARKET OF A 10% CORRECTION.

-

S&P GAINS ON JANUARYS FIRST FIVE DAYS PRECEDED A FULL YEARS GAINS 82.2% OF THE TIME

-

ON AVERAGE, NOVEMBER, DECEMBER, JANUARY CONSTITUTED THE YEARS BEST 3 MONTH SPAN. WITH THE AVERAGE RETURN OVER THIS PERIOD OF 4.2%.

-

IN JANUARY, THE DOW GAINED MORE THAN 1000 POINTS IN 2018, AND 2019.- BOTH GREAT YEARS FOR THE BROAD MARKET WITH LOW VOLATILTY.

PRETTY SICK RIGHT? REMEMBER- HISTORY DON’T REPEAT ITSELF BUT IT RHYMES!

Lets look a little deeper now into the January Effect…

THIS IS CALLED THE FIRST FIVE DAY’S: EARLY WARNING SYSTEM

-

THE LAST 45 UP FIRST 5 DAYS WERE FOLLOWED BY FULL-YEAR GAINS 37 TIMES FOR AN 82.2% ACCURACY RATIO- AND A GAIN IN ALL 45 YEARS!!!! (THIS IS SOMETHING I TAKE INTO ACCOUNT WHEN TELLING YOU TO BUY MY PORTFOLIO IN ON THE 3RD WEEK OF JANUARY.

-

ALL 8 EXCEPTIONS TO THIS STAT INCLUDED YEARS OF WAR, AND THEN THE FLAT YEARS OF 2018, 2011, 2015, AND 1994. THIS IS STATISTICAL GOLD FOLKS! SHERPA SECRETS

-

IN POST PRESIDENTIAL ELECTION YEARS (TRUE OF THIS YEAR TOO) THIS INDICATOR HAS A RECORD OF BEING CORRECT IN 13 OF THE LAST 17 YEARS!~(NOW 14 OF 18 ASSUMING THE MARKET DOESN’T DROP 23 PERCENT NEXT WEEK.)

REMEMBER- MY PORTFOLIOS ARE IN CASH FOR THIS REASON- WHY NOT LISTEN TO THE RHYME OF HISTORY RIGHT?

HAPPY HOLIDAYS TO ALL AND OF COURSE, A VERY VERY VERY BULLISH 2022!

SUBSTACK PREVIEW- GO SUBSCRIBE AND GET YOUR TRADING OFF TO A SHARPER START IN THE NEW YEAR!

REPOST ~ REPOST ~ REPOST ~ REPOST ~ REPOST

RANT-

Lets also take this time to look at the impact of inflation as it pertains to portolfolios and call out the criminal advisors who are still allocating customers into bond heavy portfolios. Simply stealing the opportunity cost of growth in equities necessary to battle purchasing power loss.

I’m looking at you 400,000 so called financial advisors!

Modern portfolio theory is doing a disservice to the generation of retiree’s who cannot count on a 4% w/d rate.- Go buy an EVERBULLISH PORTFOLIO and give yourself a chance!

SO WHAT IS GOING ON? WHAT IS CAUSING ALL OF THIS

What is rule number 1 at EVERBULLISH??

FOLLOW THE FED

REPOST!!!!

Jay Powell Added to risk off sentiment- discussing bond taper coming sooner? VERY SURPRISING HAWKISH COMMENTS- (TELLING THE KIDS WE HAVE 5 more minutes to leave the party) First last call!

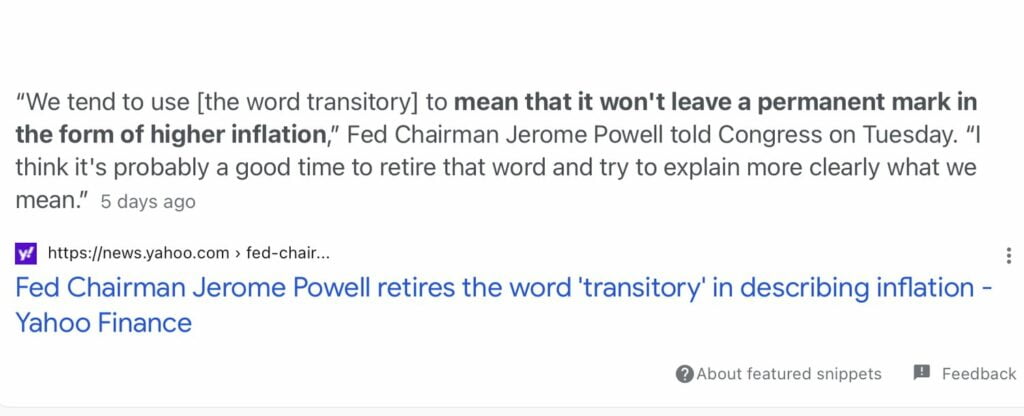

1.) NEW DEVELOPMENT- NOT GOOD! JAY POWELL HAD A CLARIFYING COMMENT THAT THE WORD “TRANSITORY” BE REMOVED FROM THE DESCRIPTION OF INFLATION.

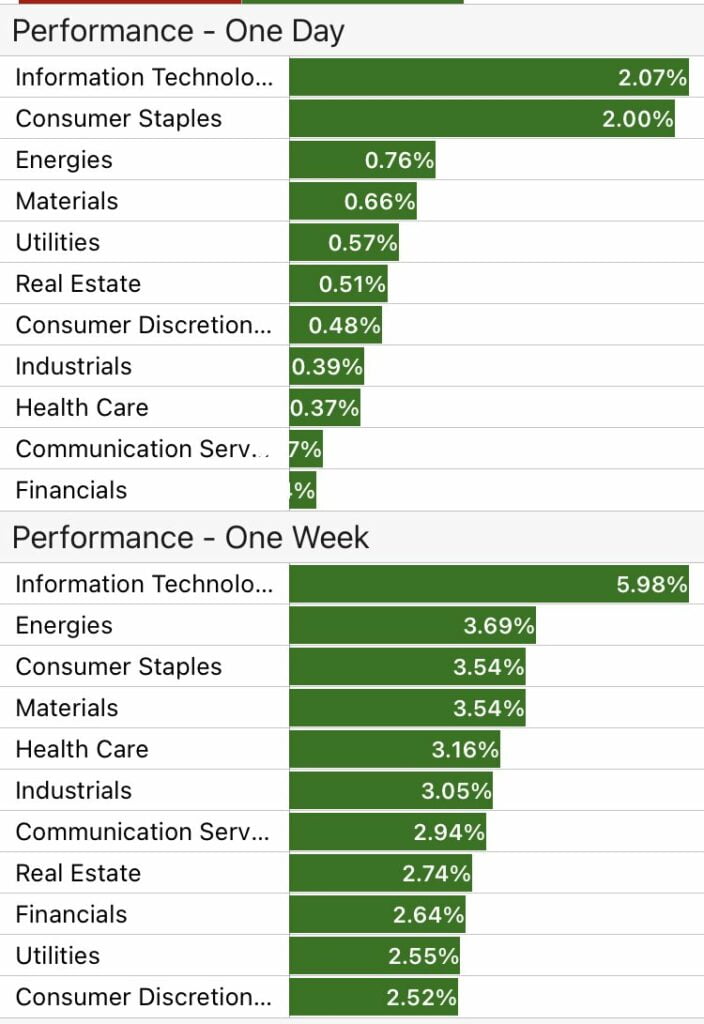

SECTOR PERFORMANCE LAST WEEK

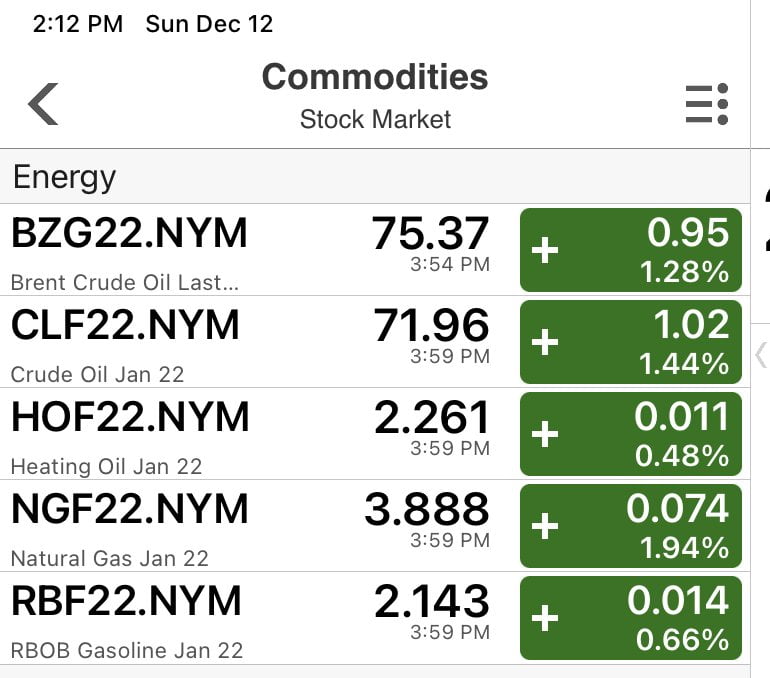

ENERGY PRICES

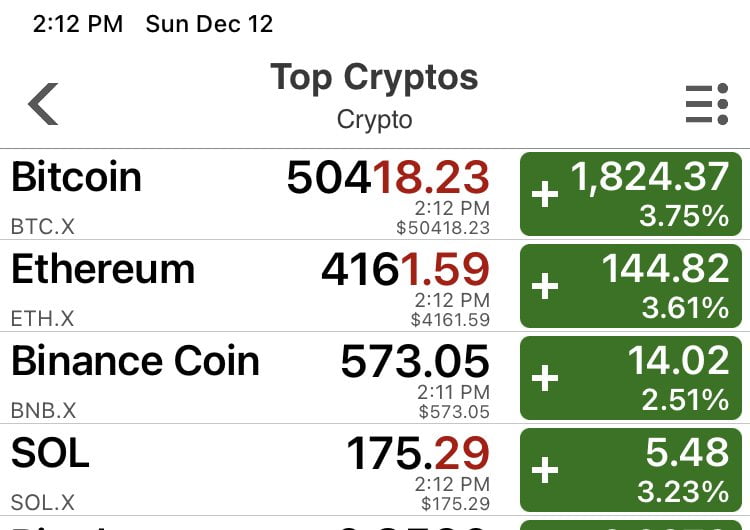

CRYPTO PRICES

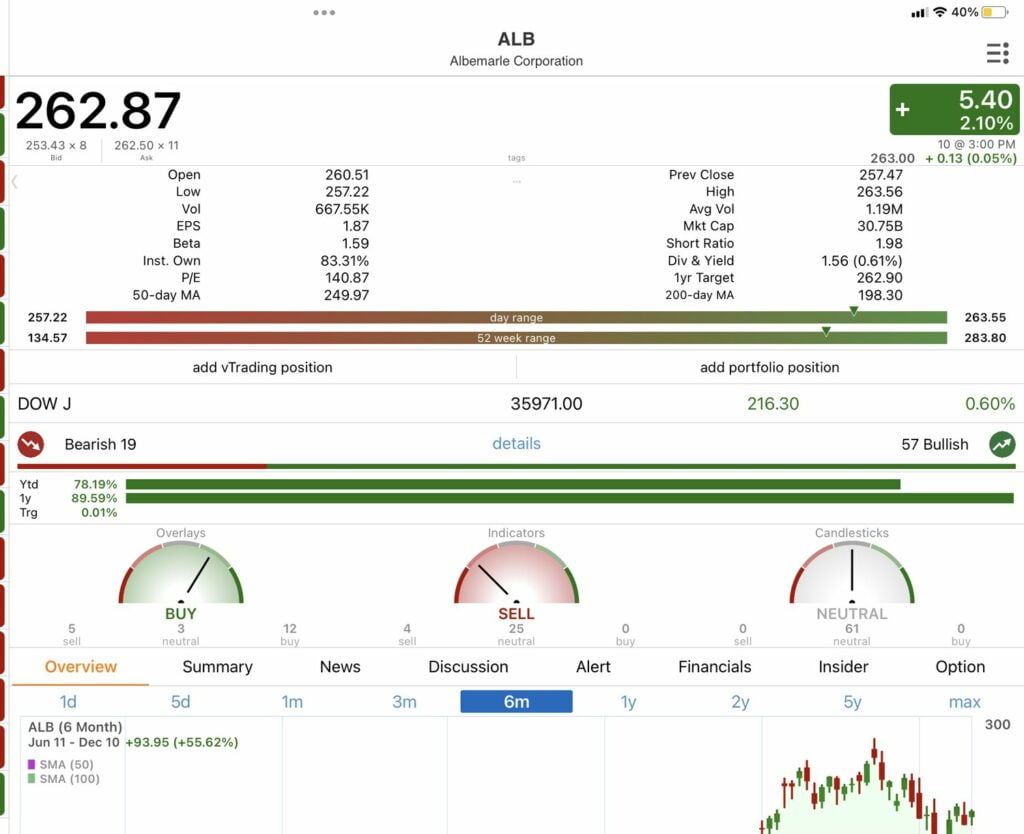

GLOBAL SPECIALTY CHEMICAL COMPANY-EV PLAY, RARE EARTH PLAY, DOLLAR HEDGE PLAY… COME ON BABY!

NEW MEGA BUY, NOT DOING MUCH ACTIVE TRADING THIS WEEK BUT WILL BE BUYING THIS LITHIUM BATTERY AND RARE EARTH MINER

I AM BUY THIS WEEK

BEST BET FOR LTH’S. THIS WILL BE A WINNER.

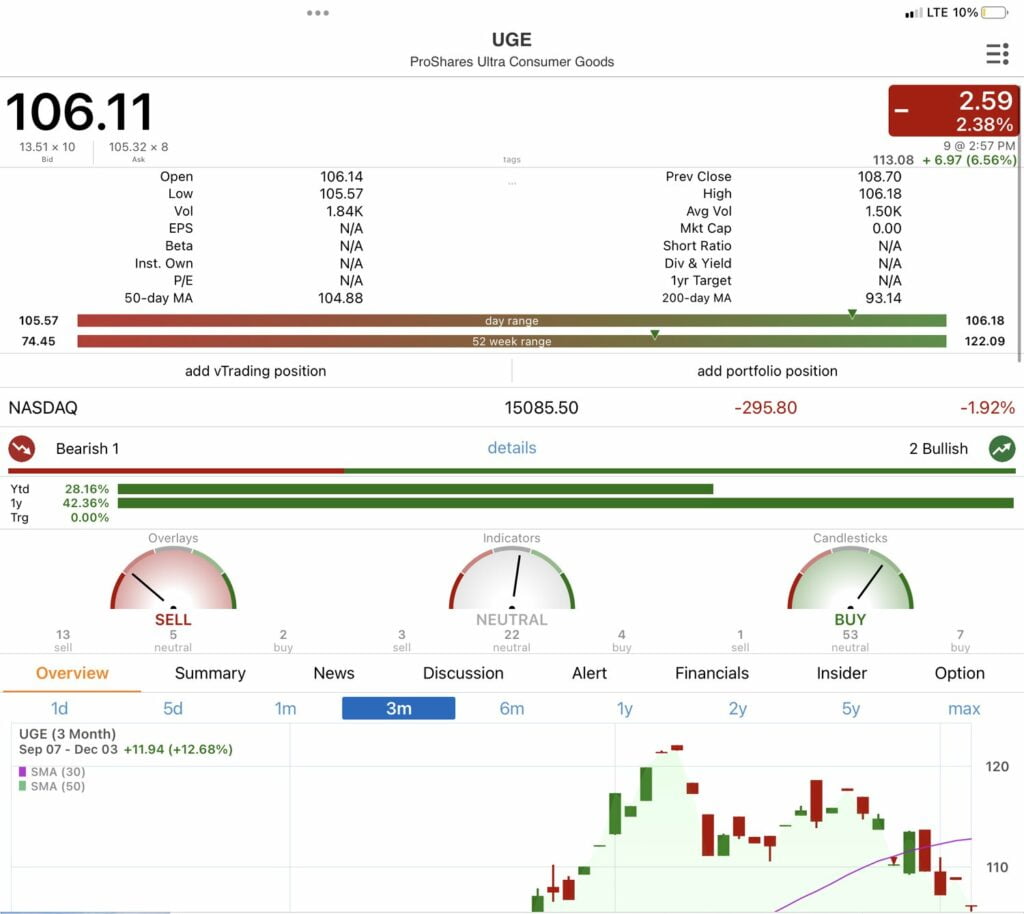

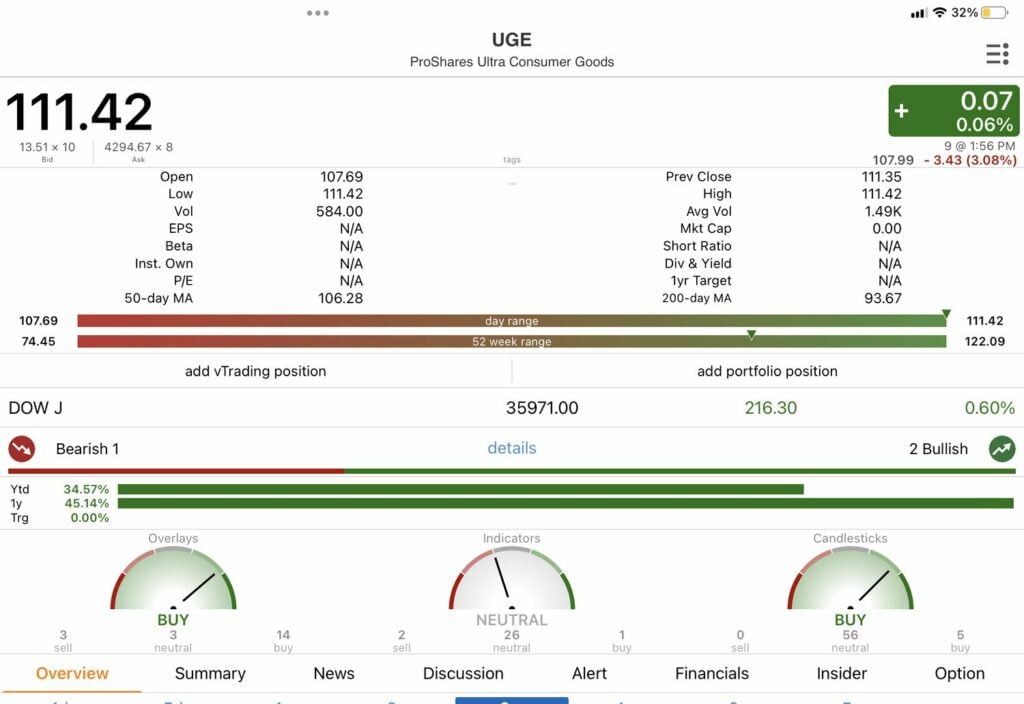

UGE 3X CONSUMER STAPLES

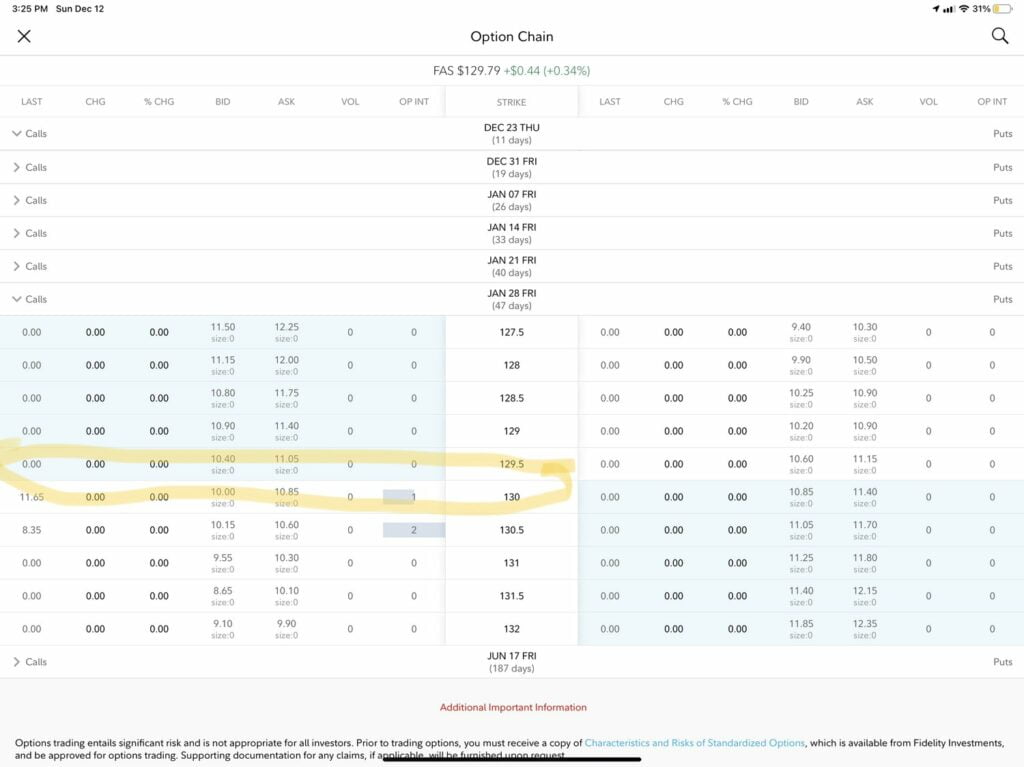

FAVORITE OPTION TRADE OF THE WEEK ON $FAS